Bankrupt Trucker Yellow Taps Estes Express for $1.3 Billion Real-Estate Sale

The real-estate deal with Estes is likely enough to cover funds Yellow borrowed from government and private lenders before bankruptcy A Yellow truck terminal in Orlando, Fla., seen last week, shortly after the company shut down and filed for bankruptcy. Photo: Paul Hennessy/Zuma Press By Soma Biswas Updated Aug. 17, 2023 4:35 pm ET Bankrupt trucking company Yellow has struck a deal to sell its real estate to rival Estes Express Lines for a minimum of $1.3 billion, enough to roughly cover the loans the company accumulated before its chapter 11. Estes, a rival trucker that had been vying to finance Yellow’s wind-down in bankruptcy, agreed instead to serve as a stalking-horse bidder for the property assets, meaning its offer is subject to higher or better proposals at a court-supervised auc

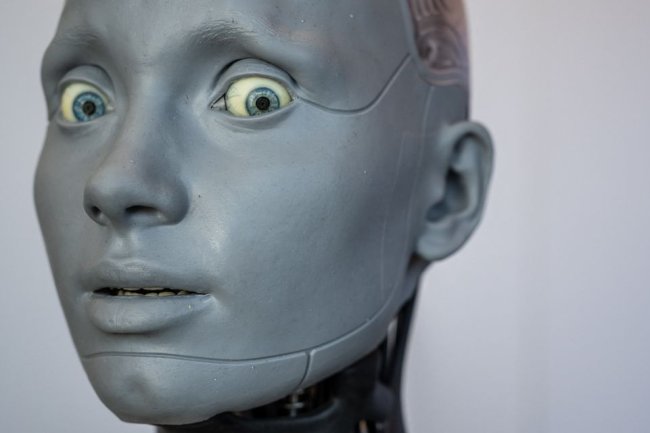

A Yellow truck terminal in Orlando, Fla., seen last week, shortly after the company shut down and filed for bankruptcy.

Photo: Paul Hennessy/Zuma Press

Bankrupt trucking company Yellow has struck a deal to sell its real estate to rival Estes Express Lines for a minimum of $1.3 billion, enough to roughly cover the loans the company accumulated before its chapter 11.

Estes, a rival trucker that had been vying to finance Yellow’s wind-down in bankruptcy, agreed instead to serve as a stalking-horse bidder for the property assets, meaning its offer is subject to higher or better proposals at a court-supervised auction, a lawyer for Yellow said at a court hearing Thursday.

Yellow also accepted an offer from Citadel and Boston hedge fund MFN Partners, the trucker’s largest shareholder, to jointly provide a $142 million bankruptcy loan, according to Yellow lawyer Allyson Smith. The loan will fund operations at the business as it winds down and sells assets. Citadel will provide $100 million of the new bankruptcy loan, while MFN will fund the rest, Smith said.

Yellow will seek bankruptcy court approval for both the debtor-in-possession loan, which will fund the company’s limited operations as it winds down, and the stalking-horse bid from Estes.

Estes’ bid ensures that Yellow’s biggest lenders, Citadel and the U.S. Treasury, owed more than $1.2 billion on two separate loans, are likely to get paid off.

“We are pleased that with Estes’ bid in hand, all of the prepetition secured debt is covered,” Smith said at the hearing.

The bankruptcy and liquidation of the 99-year-old trucking company have raised concerns that it may not raise enough money from the sale of real estate and other assets to repay its loans, including a controversial $700 million pandemic loan from the U.S. Treasury that led to a Congressional probe.

Richmond, Va.-based Estes was the fifth-largest carrier by revenue last year in the less-than-truckload market, according to SJ Consulting, and is the country’s largest privately held trucker. Yellow ranked third in the LTL business before its collapse.

A representative for Estes said the company looks “forward to working with Yellow and its creditor body to advance a mutually beneficial sale process.”

Estes Express Lines is the largest privately held trucker in the U.S.

Photo: Isabelle Bousquette / The Wall Street Journal

Citadel entered Yellow’s bankruptcy in recent days as Apollo Global Management

exited. Citadel purchased a $500 million-plus loan and stepped into the shoes of the prior lender.Apollo, which had sought its own agreement to provide a $142 million debtor-in-possession loan, abandoned Yellow’s bankruptcy when it became clear that the company had better offers from MFN Partners and Estes.

Top-ranking lenders typically provide additional new loans to borrowers to keep control of the restructuring processes and to ensure that they remain first among creditors to get repaid.

The loan from Citadel and MFN will give Yellow more time—180 days—to execute asset sales and repay the DIP lenders than Apollo would have granted, and the loan features lower fees than the Apollo DIP, Smith said.

The bulk of Apollo’s proposed DIP loan was contingent on Yellow meeting milestones for the sale of its assets, such as binding bids worth at least $250 million, court papers show.

The sale of Yellow’s portfolio of more than 160 terminals represents a rare opportunity for expansion in the trucking industry. Prime terminals are rarely offered for sale and many towns and cities oppose development of new facilities because of concerns about truck noise and pollution.

During recent earnings conference calls, executives at several rival trucking companies said they would be interested in buying some of Yellow’s locations. Chris Wofford,

a managing partner at West Palm Beach, Fla.-based Wofford Advisors, strategic advisers in global supply chains, said there is likely to be competition from smaller trucking firms too.“You are going to have a tremendous amount of interest in this portfolio,” Wofford said.

—Paul Berger contributed to this article.

What's Your Reaction?