Battle of the Activists: Hindenburg Shorts Icahn

Activist investor Carl Icahn buys stakes in companies and agitates to make changes he thinks will drive their stock up. Photo: brendan mcdermid/Reuters By Ben Foldy May 2, 2023 8:24 am ET Short seller Hindenburg Research is betting against activist investor Carl Icahn’s publicly traded holding company, the firm said. In a report published Tuesday morning, the firm said Icahn Enterprises is overvalued and is holding some assets at inflated prices. Hindenburg’s report sets up a battle between the firm’s founder, Nathan Anderson, and Mr. Icahn, who have each tormented corporate executives with allegations of malfeasance and incompetence. Mr. Icahn didn’t immediately reply to a request for comment. Hindenburg, a New York-based investment fir

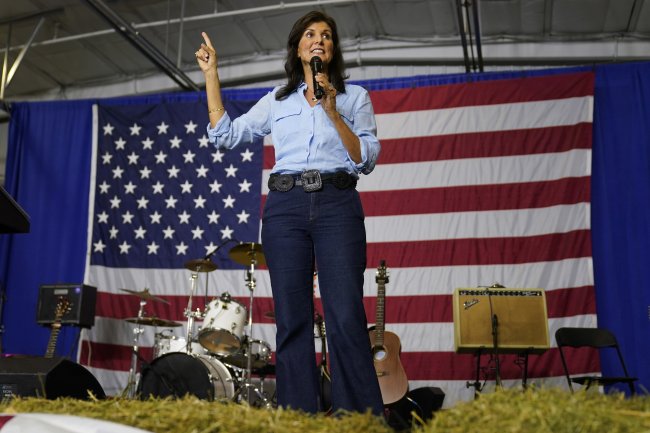

Activist investor Carl Icahn buys stakes in companies and agitates to make changes he thinks will drive their stock up.

Photo: brendan mcdermid/Reuters

By

Short seller Hindenburg Research is betting against activist investor Carl Icahn’s publicly traded holding company, the firm said. In a report published Tuesday morning, the firm said Icahn Enterprises is overvalued and is holding some assets at inflated prices.

Hindenburg’s report sets up a battle between the firm’s founder, Nathan Anderson, and Mr. Icahn, who have each tormented corporate executives with allegations of malfeasance and incompetence.

Mr. Icahn didn’t immediately reply to a request for comment.

Hindenburg, a New York-based investment firm, said in its report that Icahn Enterprises trades at a significant premium relative to its peers, buoyed by inflated valuations of its investments. The company has a market value of $18 billion.

SHARE YOUR THOUGHTS

What do you think will be the outcome of the Hindenburg vs. Icahn battle? Join the conversation below.

As an activist short-selling firm, Hindenburg makes most of its money by betting against companies and publishing its research in hopes of moving the market against their stock. It came to prominence after well-publicized bets against hydrogen truck company . Earlier this year, the firm targeted the , an Indian conglomerate that lost around $110 billion in value in the wake of Hindenburg’s report.

The Adani Group denied Hindenburg’s allegations of impropriety involving the stock. Nikola said some of Hindenburg’s allegations were correct but denied the company was a fraud.

Mr. Icahn is a legendary activist investor who buys stakes in companies and agitates to make changes he thinks will drive their stock up. He has spent his career criticizing chief executives and boards of directors and tenaciously focusing on boosting profits for shareholders.

High-profile campaigns he’s led at Dell Technologies,

Herbalife Nutrition

and

Illumina

have helped him amass a fortune valued at more than $16 billion.

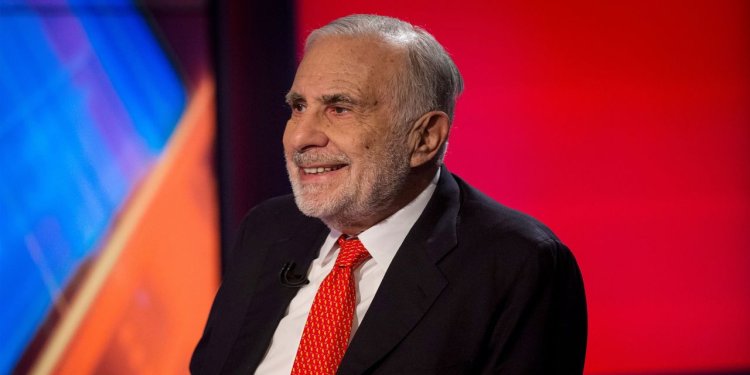

Nathan Anderson is the founder of Hindenburg Research, which makes most of its money by betting against companies.

Photo: Johnny Milano for The Wall Street Journal

Much of that fortune is tied up in Icahn Enterprises, a publicly traded limited partnership in which Mr. Icahn controls 85% of the shares. Shares of Icahn Enterprises were down 6% in premarket trading Tuesday morning.

Icahn Enterprises has taken equity stakes in businesses such as Xerox and owns companies outright. Its holdings include an energy company, an aftermarket auto parts subsidiary and a food packaging business. Its holdings at the end of last year had a net asset value of $5.6 billion, according to company filings.

Hindenburg’s report notes that the company’s stock trades at a premium of more than 200% to the reported value of its assets. Hindenburg said that premium stood out relative to other public entities run by big-name investors such as Dan Loeb’s Third Point Investors and William Ackman’s , which traded at discounts of 16% and 35%, respectively, to their reported net asset value.

Write to Ben Foldy at [email protected]

What's Your Reaction?