Bidenomics: Chinese Capitalism With American Characteristics

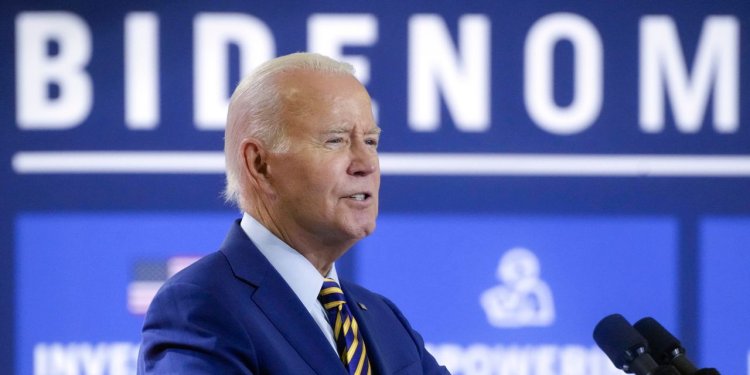

Using subsidies and mandates to pick winners and losers is a recipe for economic disaster. By Scott Hodge July 11, 2023 6:43 pm ET President Joe Biden speaks a manufacturing company in West Columbia, S.C., July 6. Photo: Meg Kinnard/Associated Press Joe Biden wants to take a page from China’s economic playbook. In a recent speech, the president officially embraced the term “Bidenomics” to describe his economic policies, which he characterized as the federal government “investing in key industries of the future, making targeted investments to promote domestic production of semiconductors, batteries, electric cars, clean energy.” In other words, the administration is pursuing a government-directed industrial policy using taxpayer subsidies and mandates to pick economic winners and losers. The administration is

President Joe Biden speaks a manufacturing company in West Columbia, S.C., July 6.

Photo: Meg Kinnard/Associated Press

Joe Biden wants to take a page from China’s economic playbook. In a recent speech, the president officially embraced the term “Bidenomics” to describe his economic policies, which he characterized as the federal government “investing in key industries of the future, making targeted investments to promote domestic production of semiconductors, batteries, electric cars, clean energy.” In other words, the administration is pursuing a government-directed industrial policy using taxpayer subsidies and mandates to pick economic winners and losers.

The administration is partly motivated by fears that the U.S. is falling behind China, where firms are openly subsidized by the government and have been gaining market share in industries once dominated by American companies. But three recent studies jointly authored by American economist Lee G. Branstetter and Chinese economist Guangwei Li suggest China’s industrial policy “successes” are overblown. China’s various industrial policies, such as “Made in China 2025”—which, like Bidenomics, targets direct subsidies, tax incentives and government loans to key sectors such as aerospace, robotics, energy-efficient automobiles and biopharmaceuticals—don’t just fall flat. They do more harm than good.

The authors find “little evidence that the Chinese government picks winners—if anything, the evidence suggests that direct subsidies tend to flow to less productive firms rather than more productive firms.” Indeed, firms became less productive after receiving subsidies and showed little improvement in research and development spending, patenting or profitability. These results should give Bidenomics boosters serious pause.

Government subsidies don’t improve Chinese firms’ productivity or profitability, but they do goose employment—at least in the short term. The Chinese government craves social stability, so the subsidies are as much a jobs program as they are an attempt to improve productivity and technology. The most visible measurement of success for many subsidy programs is the number of jobs created, not new technologies brought to market. Political considerations trump economic efficiency.

Worse, China’s industrial policies have created a culture of corruption. Companies try to manipulate the system to their advantage. The most politically connected firms tend to get the most subsidies. Some firms cook the books to get government innovation grants while others reclassify unrelated expenses as R&D to qualify for more subsidies. Still others manipulate employment numbers to get subsidies.

A notable example is the “Big Fund,” shorthand for China’s National Integrated Circuit Investment Fund. The Big Fund invested as much as $50 billion in dozens of China’s semiconductor firms as well as government “guidance” funds, which acted like venture capital firms. It was considered a huge success story until a series of corruption scandals surfaced in 2021 and 2022 involving many high-level executives affiliated with the Big Fund and recipient companies. The subsequent mass jailing of executives cast doubt on the program’s purported successes.

The Chips Act and Inflation Reduction Act won’t necessarily lead to corruption, but the Internal Revenue Service has a poor track record of monitoring and evaluating corporate tax incentives. Independent estimates now put the eventual cost of the Inflation Reduction Act tax subsidies at more than $1 trillion. The Energy Department has an equally poor record of picking winners and losers—think Solyndra and Fisker Automotive.

Bidenomics looks like a pale imitation of Chinanomics, which demonstrates why politicians shouldn’t play investment banker with taxpayer dollars. State-directed industrial policy undermines free enterprise and deprives entrepreneurs and innovators of the capital they need to improve consumers’ lives. Mimicking China’s folly surely isn’t in America’s economic interest.

Mr. Hodge is president emeritus and senior policy advisor at the Tax Foundation.

Wonder Land: Inspired by China and Saudi Arabia, Team Biden's vision for U.S. industrial policy is one in which the government explicitly leads; everyone else follows. Images: AP/AFP/Getty Images Composite: Mark Kelly The Wall Street Journal Interactive Edition

What's Your Reaction?