Can America’s stockmarket rally last?

Global temperatures have broken records three times in a weekAre these records falling faster?To read more of The Economist’s data journalism visit our Graphic Detail page.LAST YEAR you could divide the performance of American stocks into two halves. In the first six months came a crash: shares shed roughly 20% of their value by the end of June 2022. They then wiggled around—surging to relative highs in August, when it seemed that inflation had been vanquished, before plunging to fresh lows in October, when it became clear that it hadn’t. By December they returned to where they had been in June. This year, so far, has been a mirror of the events of 2022. The S&P 500, the leading stockmarket index, had climbed by roughly 16% at the close on June 30th, helped along by cooling inflation (in America at least) and a surge of excitement about what artificial intelligence (AI) might mean for productivity and corporate profits. It is more than 20% above last October’s lows, making this a new b

Global temperatures have broken records three times in a week

Are these records falling faster?

To read more of The Economist’s data journalism visit our Graphic Detail page.

LAST YEAR you could divide the performance of American stocks into two halves. In the first six months came a crash: shares shed roughly 20% of their value by the end of June 2022. They then wiggled around—surging to relative highs in August, when it seemed that inflation had been vanquished, before plunging to fresh lows in October, when it became clear that it hadn’t. By December they returned to where they had been in June.

This year, so far, has been a mirror of the events of 2022. The S&P 500, the leading stockmarket index, had climbed by roughly 16% at the close on June 30th, helped along by cooling inflation (in America at least) and a surge of excitement about what artificial intelligence (AI) might mean for productivity and corporate profits. It is more than 20% above last October’s lows, making this a new bull market.

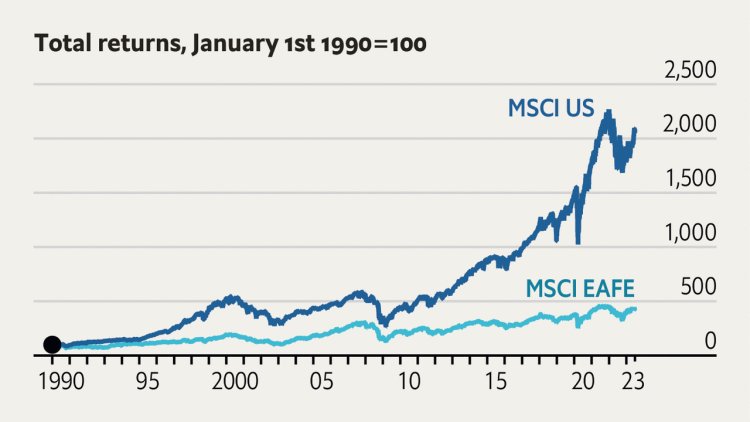

It might be tempting for investors to try to put the chaos of 2022 behind them and return to the winning strategy of the year before that: loading up on American tech stocks. But it is worth remembering the fragile foundations the rally rested on. A new paper by Cliff Asness and his colleagues at AQR Capital Management adds to the chorus of concern about lofty valuations of stocks. They find that American outperformance against shares in other rich countries, which has been the norm for many years, has been largely driven by soaring valuations. Of the 4.6% premium that American stocks have commanded over three decades, some 3.4 percentage points are explained by rising price-to-earnings ratios in America. Just 1.2 points comes from fundamentals, such as higher earnings. Outperformance because of strong fundamentals might be repeatable. Winning simply because people were willing to pay more for the same fundamentals, as Mr Asness has written, is probably not.

There are plenty of reasons to think that the second half of 2023 might complete the mirror image of last year, with uneasy ups and downs cancelling each other out—or perhaps be worse. Headline inflation in America may have eased, but the sticky “core” element (excluding food and energy) has not eased nearly as much. Investors expect American inflation to fall gently, with little further monetary tightening—which may prove too optimistic. Much of the tech excitement is forward-looking enthusiasm. For it to be proven correct, AI must actually revolutionise businesses. A flat second half, in these circumstances, might be the best you can expect.■

What's Your Reaction?