Ernst & Young, After Its Failed Split, Could Find Itself Vulnerable to Staff Poaching

The botched split attempt, after more than a year of work on it, has raised questions over whether rivals will more aggressively seek Ernst & Young talent. Photo: MAJA SMIEJKOWSKA/REUTERS By Mark Maurer April 19, 2023 5:30 am ET Ernst & Young risks losing staff to competing firms after scrapping its plan to split into separate businesses and then announcing a round of layoffs, blemishes that rivals could say reflects a wounded firm. The Big Four accounting giant last week decided not to move ahead with plans to separate into one firm focused on consulting and another centered on auditing, after a revolt led by some U.S. partners and urged by a group of EY retirees. Then earlier this week, in a move the company said was unrelated to the split, EY announced it would cut about 3,000 U.S.

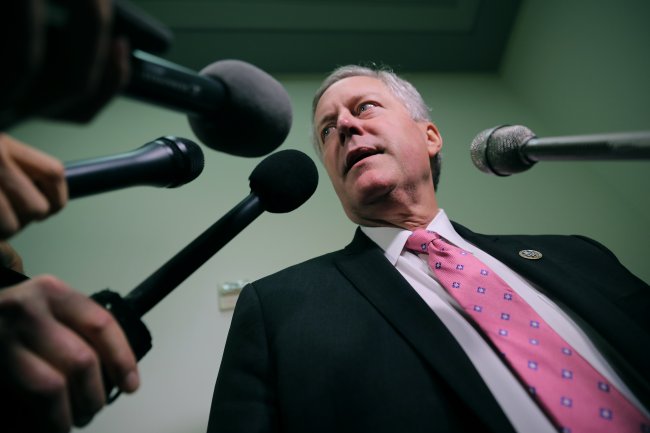

The botched split attempt, after more than a year of work on it, has raised questions over whether rivals will more aggressively seek Ernst & Young talent.

Photo: MAJA SMIEJKOWSKA/REUTERS

By

Ernst & Young risks losing staff to competing firms after scrapping its plan to split into separate businesses and then announcing a round of layoffs, blemishes that rivals could say reflects a wounded firm.

The Big Four accounting giant last week decided not to move ahead with plans to separate into one firm focused on consulting and another centered on auditing, after a revolt led by some U.S. partners and urged by a group of EY retirees. Then earlier this week, in a move the company said was unrelated to the split, EY announced it would cut about 3,000 U.S. employees, or less than 5% of its U.S. workforce.

The roughly 390,000-person firm has a retention rate of 79% globally, up from 74% a year earlier, an EY spokesman said. The U.S. firm has retention of 85.7%, up from 79.1% a year earlier, a spokesman said.

The botched split attempt, after more than a year of work on it, has raised questions over whether rivals will more aggressively seek EY talent and if EY staff will look for an employer with a less embarrassing blemish, academics and advisers said. EY’s top executives, in firmwide calls the day after the split was halted, expressed worry that the failed split had weakened it and would encourage rival firms to poach staff.

Newsletter Sign-Up

WSJ | CFO Journal

The Morning Ledger provides daily news and insights on corporate finance from the CFO Journal team.

Subscribe Now“They may want to solicit some of the staff who they perceive were, at the very least, frustrated and unhappy about not being able to split,” said Joshua Ronen, a professor of accounting at New York University, referring to other Big Four firms.

For example, KPMG is recruiting talent at all levels, especially in high-growth areas and emerging markets, to support the firm’s growth, said Sandy Torchia, KPMG’s vice chair for talent and culture in the U.S.

The fight for talent at accounting firms is compounded by a deepening shortage of auditors, particularly in the U.S. Fewer people are pursuing degrees in accounting and starting new jobs in this area, resulting in more open positions for related roles and job searches that take longer to complete. Industry observers have said increasing pay alone may not be enough to resolve the shortage.

“They’re already in this battle, stealing talent from one another,” said Ed deHaan, an associate professor of accounting at the University of Washington. “On the accounting side, any marginal change in the sort of competitive hierarchy of these firms is going to matter a lot.”

Some potential exits could come from employees who delayed plans to depart amid the effort to split. Last week on a call with partners, EY’s U.K. head, Hywel Ball, said he expects a wave of departures from staffers who wanted to leave but were waiting on the fate of Project Everest, as the planned split was known. He said U.K. retention levels were 85% this year, up from 81% a year earlier. Anna Anthony, a senior executive at EY’s U.K. arm, on the same call said the firm is working on reducing costs, which will be reflected in its plan for the fiscal year beginning in July.

Under the split, audit partners were set to pocket multimillion-dollar cash payouts to compensate them for agreeing to give up the faster-growing consulting business, whereas partners in the new consulting business were expected to receive equity after the public listing.

EY’s global leaders said in a note to partners last week that they remained committed to the principle of splitting the auditing and consulting operations. The possibility that such a deal is eventually revived could keep partners in place at the firm.

The staffers most likely to leave EY are senior managers, who are approaching the level at which they typically would buy into the partnership, given the related incentives, Mr. deHaan said. The instability at the top, disagreements between the U.S. and international entities, and the financial implications over a split collectively could spur these managers to exit for another firm, he said.

Senior managers in the audit business typically serve as intermediaries between partners and the staff. “The more you hear about turnover, that creates kind of a scare from the sense of confidence elsewhere in the firm,” said Dane Dowell, an accounting and auditing consultant, adding he expects EY will work to retain people through bonuses and other incentives.

The extent of turnover in consulting, compared with that of audit, could also hinge on the state of demand, which tends to weaken in a slowing economy. Fleeing EY is likely easier for audit and tax professionals than those in consulting due to the strength of the job market for those roles, Mr. deHaan said. People on the consulting side are likely concerned that they won’t be able to be as financially successful if the international group potentially splits off, or even if the group stays given the extensive referrals from EY U.S. to EY abroad, he said. “Even if the international group stays, I’d be worried that infighting and lack of stability undermines their collective competitive positions,” he said.

In addition to the prospect of infighting, the job has become more grueling for some workers. EY partners and staff have been under pressure to help maximize revenue and cut costs in a move to improve financial performance and boost the valuation ahead of the split, a U.K. partner said. Leaving the door open to a future transaction, the partner said, risks ongoing uncertainty and cost cutting when morale needs a significant boost. “It just means the uncertainty and the paralysis will continue,” the partner said.

Write to Mark Maurer at [email protected]

What's Your Reaction?