How Biden Can Get Antitrust Right

New draft competition guidelines released last week need revision. Not all mergers are bad. By Jason Furman and Carl Shapiro July 27, 2023 2:16 pm ET Photo: Chad Crowe President Biden has rightly put a renewed emphasis on merger enforcement, but his antitrust enforcers have compiled a weak record in federal court. Updated merger guidelines could help turn this around and advance Mr. Biden’s goal of more-vigorous competition enforcement. But a draft released last week focuses on outdated legal precedents and a presumption that growth by large and successful firms is undesirable. Regulators should revise the draft to focus more on economic analysis that is consistent with case law and the goal of protecting consumers and workers. Merger enforcement is a balancing act. Mergers can give companies leverage to raise prices, sque

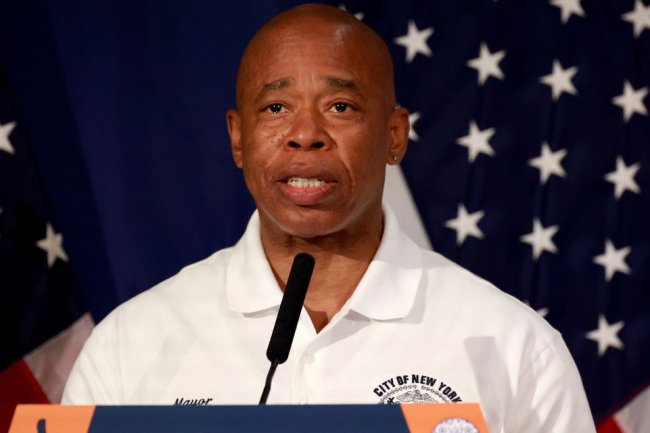

Photo: Chad Crowe

President Biden has rightly put a renewed emphasis on merger enforcement, but his antitrust enforcers have compiled a weak record in federal court. Updated merger guidelines could help turn this around and advance Mr. Biden’s goal of more-vigorous competition enforcement. But a draft released last week focuses on outdated legal precedents and a presumption that growth by large and successful firms is undesirable. Regulators should revise the draft to focus more on economic analysis that is consistent with case law and the goal of protecting consumers and workers.

Merger enforcement is a balancing act. Mergers can give companies leverage to raise prices, squeeze employees and reduce innovation. But they can also reduce prices, benefit workers and accelerate innovation by allowing companies to replace weak managers and exploit economies of scale and scope. Mergers can advance competition by ensuring that smaller competitors are viable or enabling firms that are successful in one market to inject more competition into related markets.

Antitrust law has developed to balance these competing considerations by grounding merger enforcement in fact-based economic analysis. Guidelines issued by the Justice Department and Federal Trade Commission since 1968 have been fundamental to that process. Enforcement has focused on horizontal mergers, which combine rivals, but regulators have stopped some vertical mergers, between suppliers and customers, as well.

Merger guidelines aren’t enforceable regulations. They have also never attempted to be a legal brief or offered an interpretation of the case law. Instead they have described widely accepted economic principles that the Justice Department and the FTC use to analyze mergers. As a result, the guidelines have commanded widespread respect and bipartisan support. Amazingly, for at least 25 years, when regulators have challenged mergers in court, the merging firms themselves have accepted the framework articulated in the guidelines.

The new draft guidelines depart sharply from previous iterations by elevating regulators’ interpretation of case law over widely accepted economic principles. The guidelines have long helped courts use economic reasoning to evaluate government challenges to mergers. They shouldn’t become a debatable legal brief or, worse, a political football.

Regulators say the guidelines are out of date and need to be updated to reflect the modern economy. Yet their draft draws heavily on Brown Shoe Co. v. U.S. (1962), a widely criticized Supreme Court case.

Many of the specific draft guidelines build on and improve the 2010 Horizontal Merger Guidelines. We agree, for instance, that “mergers should not eliminate substantial competition between firms”—although we worry that the courts may not see it that way. The discussion of mergers involving multi-sided platforms reflects recent advances in economic thinking. The treatment of mergers that eliminate potential competitors is also timely and valuable, especially for the pharmaceutical industry and tech.

Unfortunately, other parts of the draft lack an adequate economic foundation. They contain a structural presumption against many vertical mergers unsupported by theory or evidence. The proposed guideline on acquisitions of products or services that rivals may use to compete includes legal wishful thinking about how commitments made by the merging parties are treated, as the recent court rebuke of the FTC’s attempt to block Microsoft’s acquisition of Activision illustrates.

Likewise, a new guideline states that “mergers should not entrench or extend a dominant position,” where a “dominant position” means a market share of at least 30%. As we read this guideline, many nonhorizontal deals that enable the acquiring firm to become more efficient, and thus gain market share or compete more effectively in adjacent markets, would be considered illegal even if they benefit consumers and workers. If this isn’t the intention, revisions are needed.

We’re pleased to see that antitrust regulators will continue to consider efficiencies when they review mergers, especially since FTC Chairwoman Lina Khan has said that efficiencies and pro-competitive effects can’t “rescue an otherwise unlawful transaction.” But we are troubled by the draft guidelines’ claim that efficiencies won’t be counted, even if they benefit consumers and workers, for a merger that furthers a trend toward horizontal concentration or vertical integration. Imagine if regulators had applied such a rule to the automobile industry in the 1910s.

“Anti-competitive mergers can hurt people and drive up costs as well,” President Biden said while announcing the release of the draft guidelines on July 19. Preventing harm to the public should be regulators’ North Star as they revise their merger guidelines. They should rely less on the belief that mergers are bad—and less on old case law—and instead focus on how mergers affect people’s economic lives. But even the best guidelines can’t restore proper merger enforcement. That will require Congress to provide more funding and a judiciary that is more open to enforcement and less enamored of laissez-faire antitrust theories.

Mr. Furman, a professor of the practice of economic policy at Harvard, was chairman of the White House Council of Economic Advisers, 2013-17. Mr. Shapiro is a professor of economics at the University of California, Berkeley and a former CEA member. He served as deputy assistant attorney general for economics in the Justice Department’s Antitrust Division (2009-11) and led the drafting there of the last version of the horizontal merger guidelines in 2010.

Journal Editorial Report: It's too early to know if 'No Labels' could help throw 2024 election to Trump. Images: AP/AFP/Getty Images Composite: Mark Kelly The Wall Street Journal Interactive Edition

What's Your Reaction?