Lyft to Expand Its Ad Business as New CEO Eyes a Turnaround

The ride-sharing company and its larger rival, Uber, are racing to build significant ad operations Ride-sharing company Lyft has begun selling display ads that run in its ride-share app and says it will introduce video ads later this year. Photo: Cfoto/Zuma Press By Patrick Coffee Aug. 10, 2023 6:00 am ET Lyft has introduced new advertising products as part of an ongoing effort to develop a consistent revenue stream beyond its core ride-share service. The company this week will begin serving display ads on its eponymous app to customers throughout all stages of their experience. Ads will appear while users wait for rides, when they match with drivers and during their trips. Lyft also plans to incorporate video ads into the app before the end of the year and to expand

Ride-sharing company Lyft has begun selling display ads that run in its ride-share app and says it will introduce video ads later this year.

Photo: Cfoto/Zuma Press

Lyft has introduced new advertising products as part of an ongoing effort to develop a consistent revenue stream beyond its core ride-share service.

The company this week will begin serving display ads on its eponymous app to customers throughout all stages of their experience. Ads will appear while users wait for rides, when they match with drivers and during their trips. Lyft also plans to incorporate video ads into the app before the end of the year and to expand the reach of other ad products such as in-car screens, said Chief Business Officer Zach Greenberger.

The moves come as both Lyft and Uber Technologies, Lyft’s chief competitor in the ride-share business, claimed significant gains from their nascent advertising businesses. Uber said in June that it would begin selling in-app video ads.

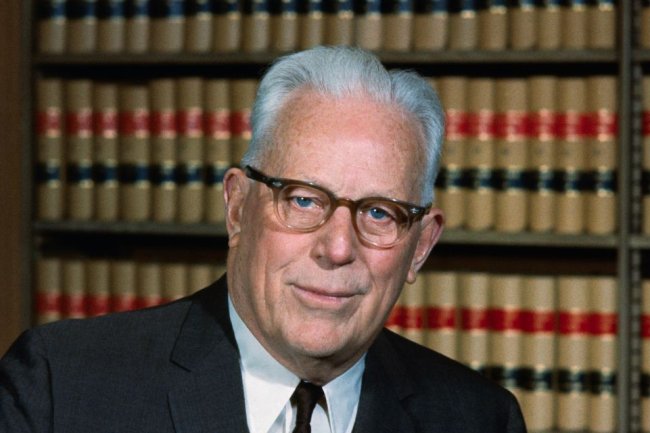

Lyft CEO David Risher

Photo: Michael Liedtke/Associated Press

It also follows efforts by David Risher, who was named Lyft’s chief executive earlier this year, to turn the struggling business around by lowering prices, cutting hundreds of jobs and exploring strategic options for Lyft’s bike unit, including a possible sale.

Lyft users check the app an average of nearly nine times per ride, creating many opportunities for them to notice the new ads, according to Greenberger. That fact, combined with the pool of first-party data Lyft collects from its users, will help attract advertisers, he said.

The data points initially available to target ads include users’ payment methods, ride histories and so-called lifestyle segments, Greenberger said. All data will be anonymized and aggregated, he said.

Users will have the option to opt out of data sharing, but not the ads themselves, he added.

Beyond the app, Lyft will begin replacing static ad displays at its bike-share stations with digital screens and increase its drivers’ in-car tablets and car-top digital displays, both of which also carry ads, Greenberger said.

Lyft currently has around 6,500 in-car tablets and 800 car-top displays. It also operates 3,250 bike stations in the New York, Chicago and San Francisco metropolitan areas, most of which include ad displays, he said.

The ride-sharing company hopes that a plan to share an unspecified portion of its ad revenue with drivers will attract more drivers, said Greenberger. Uber also allows drivers to claim a portion of the revenue generated by car-top and tablet ads. Uber’s Uber Eats food delivery service has provided much of its ad sales growth to date; Lyft doesn’t offer a comparable product.

“For us I think there is a very clear and deliberate focus on transportation,” said Greenberger. “We’re going to continue to invest in our omnichannel strategy that we believe does create differentiation from our competition, because we can hit a user on every kind of step and part of their transportation journey, which also includes our massive bike network.”

Uber’s market share is considerably larger than Lyft’s. In the week leading up to June 25, Uber had 2.7 million daily active users and 1.54 million drivers in the U.S., while Lyft had 1.79 million and 410,000, respectively, according to consumer intelligence firm Global Wireless Solutions.

Lyft’s ad revenue grew 400% year-over-year in the second quarter, according to Greenberger. The company, however, doesn’t disclose its ad revenue and hasn’t provided public goals for the business.

Uber hasn’t broken out ad revenue, but CEO Dara Khosrowshahi said during this month’s earnings call that the company had surpassed $650 million in annual run rate for ad sales and was on track to meet its goal of $1 billion in ad revenue in 2024.

Lyft has partnered with adtech company Rokt to sell ads through that company’s programmatic, or automated, marketplace while also hiring more sales representatives to sign deals directly with brands, said Greenberger.

It has also signed a deal with measurement firm Kantar to allow marketers to better track their ad buys’ effects on factors such as brand awareness and purchase intent, and is building its own internal advertising technology system to provide additional key performance indicator metrics to buyers, he said.

Initially, all ads shown throughout a given user’s trip will come from the same brand, but Lyft plans to eventually allow multiple brands to buy ads on different stages of that trip, according to Greenberger.

Lyft said Tuesday that revenue, total drivers and riders grew in the second quarter while losses narrowed, though the company hasn’t yet reached prepandemic totals for drivers or riders.

Write to Patrick Coffee at [email protected]

What's Your Reaction?