Supreme Court Blocks Purdue Pharma’s $6 Billion Sackler Opioid Settlement

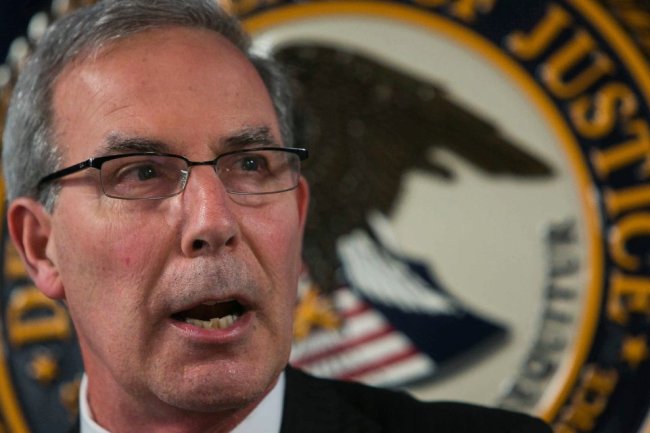

The justices will examine if bankruptcy courts can force claimants to sign away their legal rights in a settlement Prescription painkiller OxyContin is made by Purdue Pharma. Photo: George Frey/REUTERS By Jess Bravin and Alexander Saeedy Updated Aug. 10, 2023 7:39 pm ET | WSJ Pro WASHINGTON—The Supreme Court blocked Purdue Pharma’s $6 billion settlement of opioid lawsuits against its Sackler family owners, agreeing to hear the Justice Department’s claim that the drugmaker’s bankruptcy plan improperly wipes out potential liability to additional parties for allegedly fueling the opioid addiction crisis. The justices, by taking up the case and preventing Purdue from carrying out the settlement during the appeal, en

Prescription painkiller OxyContin is made by Purdue Pharma.

Photo: George Frey/REUTERS

WASHINGTON—The Supreme Court blocked Purdue Pharma’s $6 billion settlement of opioid lawsuits against its Sackler family owners, agreeing to hear the Justice Department’s claim that the drugmaker’s bankruptcy plan improperly wipes out potential liability to additional parties for allegedly fueling the opioid addiction crisis.

The justices, by taking up the case and preventing Purdue from carrying out the settlement during the appeal, ensured that a sizable chunk of tens of billions of dollars pledged by the pharmaceutical industry to combat the opioid crisis will be delayed—or not paid at all. But the move eventually could open the door for parties who balked at the deal to win additional compensation.

The court’s review also will extend the long, costly litigation alleging that drug manufacturers, distributors and pharmacies oversupplied painkillers as opioid addiction grew into an epidemic.

The legal uncertainty also will continue for the Sacklers, who sought to use Purdue’s chapter 11 proceedings to resolve opioid lawsuits aimed at holding them responsible for the costs of addiction and clawing back distributions they received from the closely held manufacturer before its bankruptcy.

The case hinges on whether the nation’s bankruptcy courts have the jurisdiction to approve settlements between a bankrupt company’s creditors and third parties, such as insiders like Purdue’s owners, who wouldn’t otherwise be protected from liability. The court’s decision on the proposed deal, which Purdue needs to leave bankruptcy, is expected before July 2024.

The justices ordered an expedited schedule for hearing the case, setting oral arguments for December. In a brief unsigned order, the court said it would consider whether bankruptcy courts can extinguish legal claims against nonbankrupt parties to a chapter 11 case when some claimants don’t agree.

The Justice Department has taken the position that the Sacklers, as owners of Purdue, can’t use its bankruptcy case to be released from all opioid-related claims, known and unknown, against them. Bankruptcy courts have no authority to force creditors to sign away their legal rights if they don’t like the settlement terms being offered in chapter 11, according to the department’s bankruptcy watchdog, the Office of the U.S. Trustee.

The Sacklers have required such a release from liability as a condition of paying a $6 billion settlement that would end Purdue’s bankruptcy and mark one of the largest legal settlements stemming from the opioid epidemic.

Purdue said it was “confident in the legality of our nearly universally supported Plan of Reorganization, and optimistic that the Supreme Court will agree.” But the drugmaker complained the U.S. Trustee “has been able to single-handedly delay billions of dollars in value that should be put to use for victim compensation, opioid crisis abatement for communities across the country, and overdose rescue medicines.”

The Justice Department declined to comment.

Defendants in mass litigation have long used chapter 11 to drive a resolution and get a fresh start for any affiliates, co-defendants and other third parties that may share liability. By offering these third parties a full release from liability, bankruptcy courts encourage settlements that can’t be forged anywhere else.

Purdue Pharma is based in Stamford, Conn.

Photo: Frank Franklin II/Associated Press

The Boy Scouts of America, for example, used releases for its volunteer affiliates and religious partners in its chapter 11 case to ease the largest settlement of sex-abuse claims in U.S. history. Chapter 11 plans routinely include releases for private-equity firms, corporate executives and others with connections to a bankruptcy case but not bankrupt themselves.

The government and other critics argue that by granting releases to third parties, bankruptcy courts are overstepping their mandate of rehabilitating troubled businesses and becoming an alternative to the civil justice system where alleged wrongdoers can avoid jury trials and pressure plaintiffs into settlements.

Federal appeals courts have reached different conclusions over whether these types of releases are allowed in chapter 11, setting the stage for the Supreme Court to finally settle the question.

“There are a lot of corporations over the past 20 years that have found hope for almost unsolvable problems by filing for bankruptcy and doing deals with these types of releases,” said Jared Ellias, a professor at Harvard Law School who focuses on bankruptcy issues. “This decision could reshape the role of the bankruptcy system in addressing pressing societal issues.”

Purdue filed for bankruptcy in 2019, besieged by thousands of lawsuits from state and local governments alleging that it oversupplied its flagship drug, the addictive painkiller OxyContin. Many lawsuits filed by state governments, municipalities and victims of opioid addiction against privately owned Purdue also named the closely held company’s family owners, who have denied wrongdoing.

The Sacklers have said that when Purdue distributed $10 billion to them from 2008 to 2017, they didn’t anticipate the wave of lawsuits that would emerge and drive the company to bankruptcy. About half of the distributions made to the family went toward taxes or were reinvested in the business, according to court papers.

Purdue’s creditors alleged after the company’s bankruptcy filing that dividends previously paid to the family were part of a deliberate scheme to move money out of Purdue to thwart the collection of any future judgments issued over the company’s sales of OxyContin. Much of the family’s wealth is held in hard-to-reach trusts overseas, making collection difficult even if the Sacklers were successfully sued.

The company, nearly all its creditors and the Sacklers instead reached a proposed settlement shielding the family members from current and future civil opioid lawsuits in exchange for funding for opioid-abatement programs and compensation for people harmed by Purdue’s products.

The Justice Department has argued that nonconsensual releases are open to abuse, while Purdue and its creditors have argued that granting full releases to the Sacklers will expedite payments to communities around the country to combat opioid misuse.

The Sacklers’ deal constitutes a sizable chunk of the estimated $50 billion in settlement payments the pharmaceutical industry has pledged for opioid abatement programs.

If the justices rule that the $6 billion deal can’t proceed, that could send the company, its creditors and the Sacklers back to the drawing board, threatening the survival of Purdue, which the family has agreed to surrender.

—Alexander Gladstone contributed to this article

Write to Jess Bravin at [email protected] and Alexander Saeedy at [email protected]

What's Your Reaction?