What do high US inflation and China’s deflation risk mean for the global economy?

2023.05.16 05:00As China’s consumer price index (CPI) approached zero growth in April, the numbers stood in sharp contrast to those of the United States, where inflation remained at a relatively high level of 4.9 per cent and kept pressure on the Federal Reserve.The fire and ice situation serves to complicate a fragile global economic recovery that is already being haunted by the Russia-Ukraine war and persistent China-US trade tensions.Consumer inflation is the rising costs of goods and services in an economy and, as a result, reflects the decreasing purchasing power of consumers, all other things being equal. Rising income can offset the impact of rising inflation. “Real” income growth is adjusted to subtract the impact of inflation.Meow money, more travel: what purchases are Chinese prioritising this year?China’s April consumer inflation grew by 0.1 per cent from a year earlier in April – the lowest rate since February 2021, according to the National Bureau of Statistics.US consumer

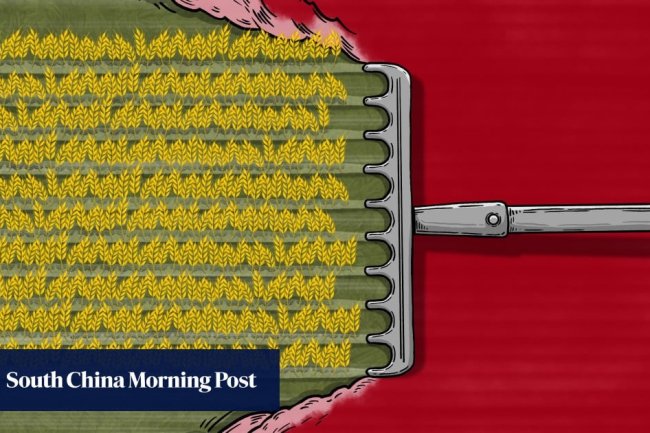

As China’s consumer price index (CPI) approached zero growth in April, the numbers stood in sharp contrast to those of the United States, where inflation remained at a relatively high level of 4.9 per cent and kept pressure on the Federal Reserve.

The fire and ice situation serves to complicate a fragile global economic recovery that is already being haunted by the Russia-Ukraine war and persistent China-US trade tensions.

Consumer inflation is the rising costs of goods and services in an economy and, as a result, reflects the decreasing purchasing power of consumers, all other things being equal. Rising income can offset the impact of rising inflation. “Real” income growth is adjusted to subtract the impact of inflation.

Meow money, more travel: what purchases are Chinese prioritising this year?

China’s April consumer inflation grew by 0.1 per cent from a year earlier in April – the lowest rate since February 2021, according to the National Bureau of Statistics.

US consumer inflation, meanwhile, saw year-on-year growth of 4.9 per cent in the same period, though this has declined for 10 consecutive months, the US Bureau of Labor Statistics said last week.

In its World Economic Outlook released in April, the International Monetary Fund estimated a 2 per cent rise in China’s CPI for this year, versus 4.5 per cent for the US.

Beijing’s officials tend to attribute the US-China disparity to the different approaches of both countries to counter the pandemic shocks.

In contrast to the US Federal Reserve’s unprecedented balance sheet expansion to a soaring US$8.5 trillion, Beijing has refrained from using a large-scale loosening and withdrew coronavirus stimulus measures as early as the second half of 2020.

From a technical perspective, both have different weightings in their consumer price baskets. US consumers have been more prone to spikes in global energy prices and supply-chain disruptions during the Russia-Ukraine conflict.

Ping An Securities estimated in March that industrial goods, which China has a strong ability to manufacture, accounted for nearly half of China’s core CPI basket, while industrial goods made up less than 22 per cent in the US.

Meanwhile, food accounts for 19 per cent of China basket’s, higher than 13.47 per cent in the US. Energy is weighted at 3.5 per cent in China, compared with 7 per cent in the US.

The nearly zero growth in China’s consumer prices in April, along with producer price declines for seven straight months, raised market concerns about deflation and put policymakers in a tight spot.

The worries deepened as seven provinces and major cities, including Shanghai, Henan, Liaoning and Shanxi, reported year-on-year contractions in consumer prices last month.

Many Chinese economists blamed the currently low readings on the high comparison base from last year, when commodity prices jumped during the Ukraine war.

Citic Securities, a leading Chinese investment bank, said last month that the likelihood of China facing deflation was pretty low, given the gradual recovery of its tourism sector and the potential rise in food prices.

Is China seeing deflation? Indices continue to fall amid rocky economic rebound

“I don’t see the risk of deflation here [in China],” Krishna Srinivasan, director of the International Monetary Fund’s Asia-Pacific division, said at a news briefing in Beijing last week.

In the first-quarter monetary policy implementation report released on Monday, the People’s Bank of China denied the presence of deflation, noting that the country’s core CPI, which excludes the volatile prices of food and energy, rose by 0.7 per cent in April, year on year.

However, the world’s second-largest economy has faced inadequate demand, as flagged by Chinese leadership at the quarterly analysis meeting in late April.

“We’ll enhance the coordination with fiscal policy to create a joint force to boost demand, improve the economic recovery and maintain the basic stability of consumer prices,” the People’s Bank of China said.

‘Increasingly clear’ weak demand cools China exports, slowdown until late 2023

Beijing and Washington, at the helms of the world’s two largest economies, have long been urged to enhance macroeconomic and monetary policy coordination, as the global economy could fall into a recession, while debt problems haunt emerging markets.

Chinese officials have moved to shore up the nation’s defence by dumping US Treasury holdings and reducing its US dollar exposure, while closely monitoring cross-border capital flows and potential shocks to domestic financial markets.

The consumer inflation divergence, however, could force both countries to lay out different priorities in their work agendas, as bilateral tensions persist.

China has shifted attention to bolstering tech innovation and shoring up the domestic economic recovery, which is uneven with manufacturing and private business lagging behind. Its central bank has maintained ample market liquidity but remains reluctant to lower its policy rate.

The Fed is still struggling to lower inflation to its 2 per cent target, and its decisions – either tightening with further rate hikes – continue to test American banks and emerging markets that have seen worrisome capital outflows.

What's Your Reaction?